Find future value of ordinary annuity

The present and future values of an annuity due can be computed as follows. In the United States an annuity is a financial product which offers tax-deferred growth and which usually offers benefits such as an income for life.

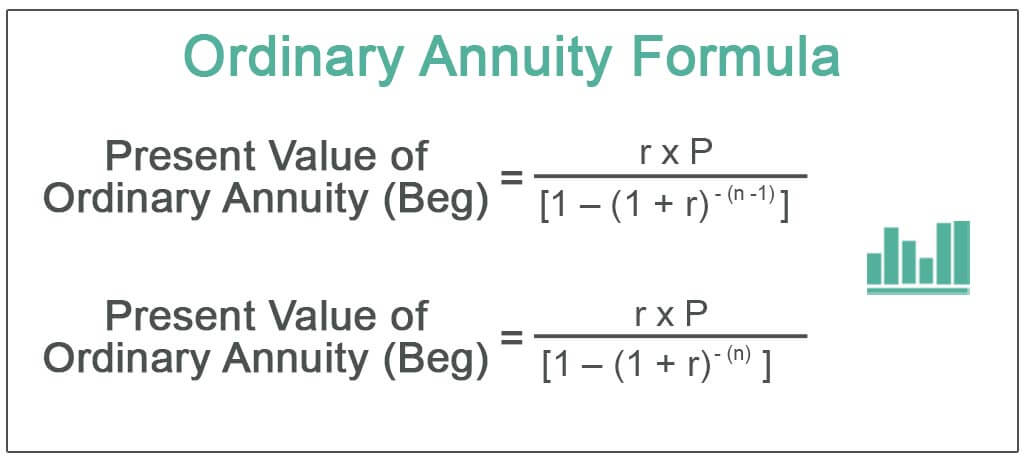

Ordinary Annuity Formula Step By Step Calculation

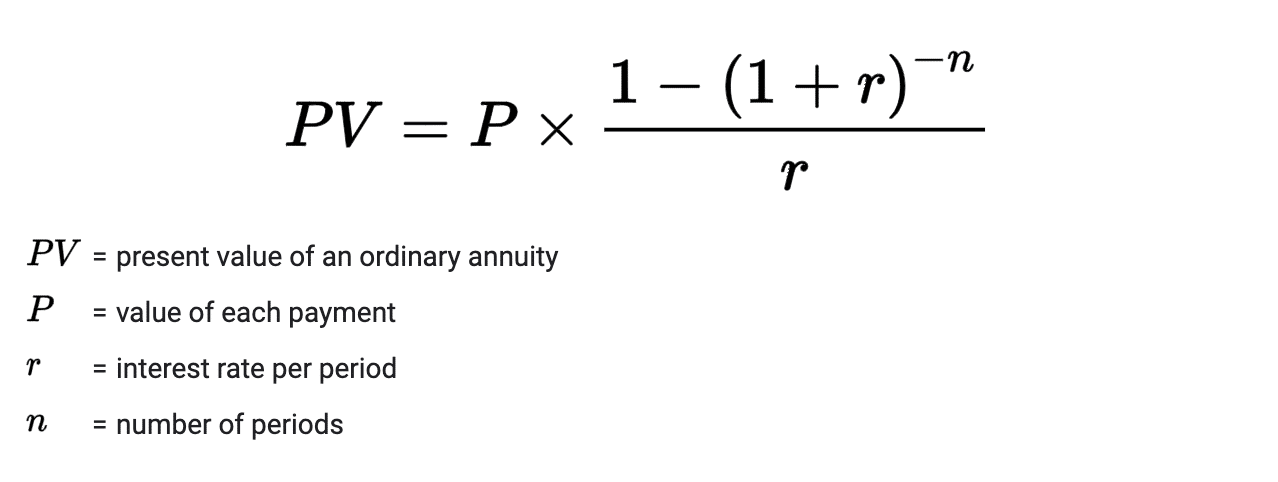

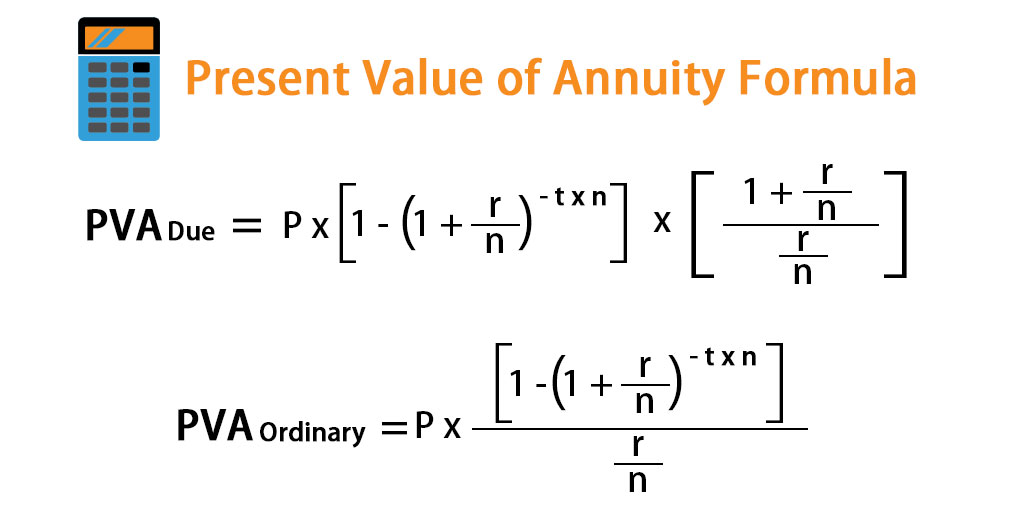

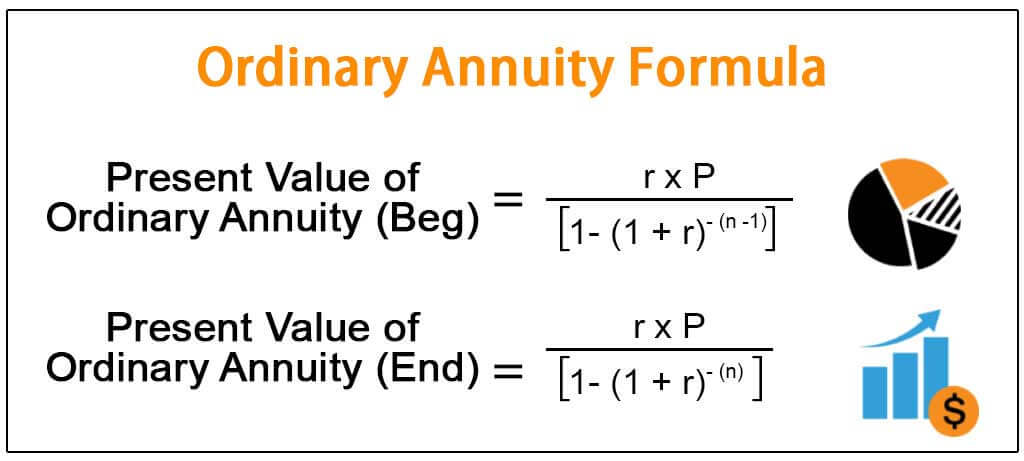

The present value of an annuity is the value of a stream of payments discounted by the interest rate to account for the fact that payments are being made at various moments in the future.

. In most cases you earn ordinary income as a direct result of your labor. FV due Future value of annuity due. Lets assume we have a series of equal present values that we will call payments PMT and are paid once each period for n periods at a constant interest rate iThe future value calculator will calculate FV of the series of payments 1 through n using formula.

Calculate the future value of an annuity due ordinary annuity and growing annuities with optional compounding and payment frequency. For ordinary regular annuity where all payments are made at the end of a period use 0 for type. The annuity may be either an ordinary annuity or an annuity due see below.

Withdrawals affect the variable annuitys death benefit cash surrender value and any living benefit and may also be subject to a contingent deferred sales. If you understand the concepts and apply them youll be able to make better decisions. Present Value Of Annuity Calculation.

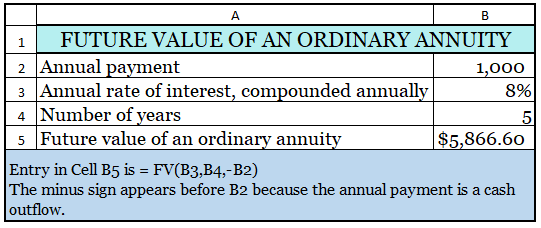

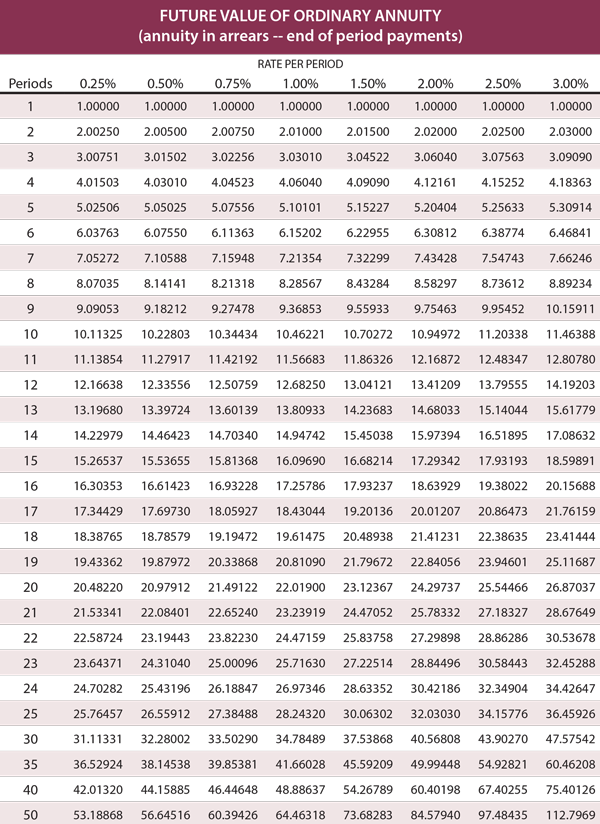

Below is an example of an annuity table for an ordinary annuity. Future value of an annuity. For example youll find that the higher the interest rate the lower the present value because the greater the discounting.

Withdrawals will reduce the death benefit and account value. Studying this formula can help you understand how the present value of annuity works. This is the default value that applies automatically when the argument is omitted.

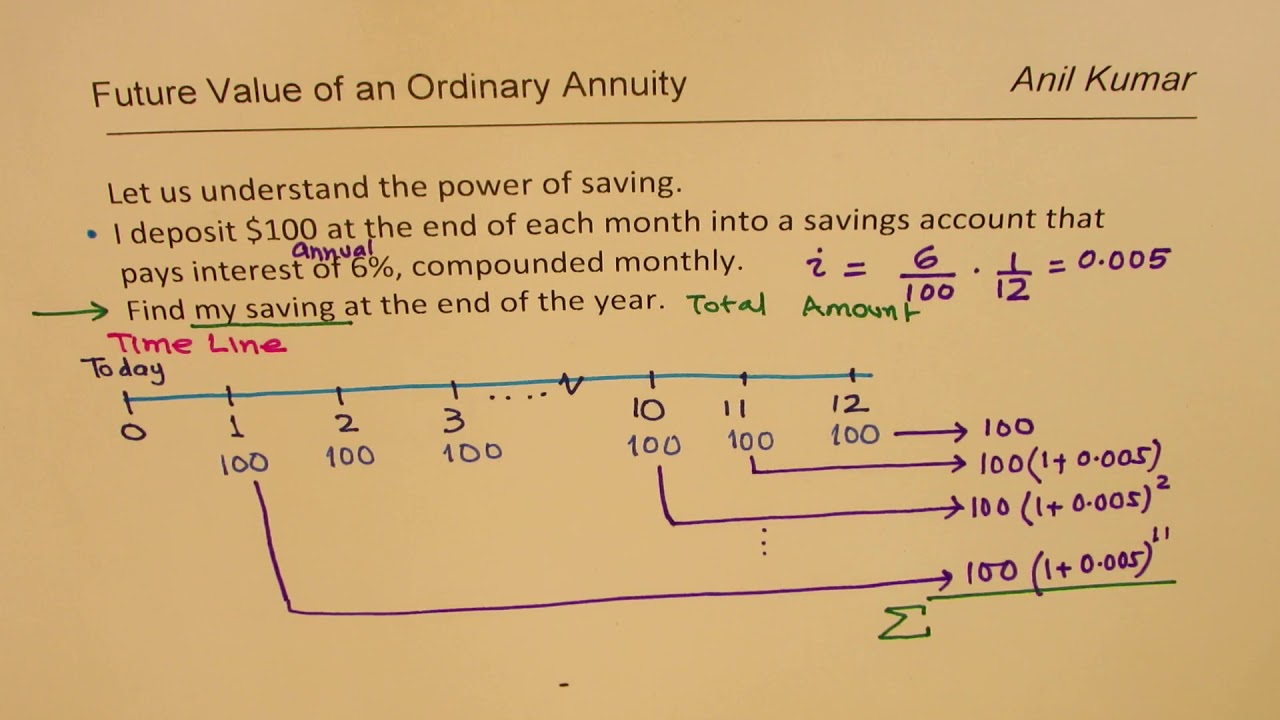

Where is the number of terms and is the per period interest rate. Calculating the Future Value of an Ordinary Annuity. Interest earned in your annuity compounds tax-free until you begin making withdrawals which means your value can grow at a far faster rate.

The present value of an annuity is the current value of a set of cash flows in the future given a specified rate of return or discount rate. Distributions of taxable amounts from a non-qualified annuity may also be subject to the 38 Unearned Income Medicare Contribution tax that is generally imposed on interest dividends and annuity income if your modified adjusted gross income exceeds the applicable threshold amount. For an annuity spread out over a number of years specify.

Use this annuity tax calculator to compare the tax advantages of saving in an annuity versus a taxable account. Payments are made for at least the length of the specified period. For a lump sum investment that will pay a certain amount in the future define the future value B5.

They pay out a guaranteed minimum such as a fixed annuity does but a portion of it is also tied to the performance of the investments within which is similar to a. The PV will always be less than the future value that is the sum of the cash flows except in the rare case when interest rates are negative. Typically these are offered as structured products that each state approves and regulates in which case they are designed using a mortality table and mainly guaranteed by a life insurerThere are many different varieties of.

Future Value Annuity Formula Derivation. Fixed Deferred Annuity Calculator. Future Value FV of Ordinary Annuity FV of ordinary annuity means the FV of same PMT PMT 0 occurred at end of each period for a finite number of periods.

Your firm decides to invest 10000 a year into a joint venture and you expect to earn an 8 return for 10 years. PV due PV ord 1 r PV due. Remember that all annuity tables contain the same PVIFA factor for a given number of periods at a given rate just like all times tables contain the same product for any two given numbers.

The present value is given in actuarial notation by. Present value is linear in the amount of payments therefore the. Withdrawals of taxable amounts will be subject to ordinary income tax and possible mandatory federal income tax withholding.

Annuity formulas and derivations for future value based on FV PMTi 1in - 11iT including continuous compounding. Any variations you find among present value tables for ordinary annuities are due to rounding. Present Value Of An Annuity.

This type of annuity makes payments for as long as one or both of the annuitants are living but for NO LESS THAN ie a minimum of a certain number of years. Ordinary income and unearned income differ in how they are earned and taxed. In which case the estate may have to go through a process of returning the money.

Future value FV is a measure of how much a series of regular payments will be worth at some point in the future given a specified interest. The future value table. The time of money concepts have a big impact on your companys cash flow.

Single Life or Joint Life Annuity with Certain Period. An indexed annuity sometimes called an equity-indexed annuity combines aspects of both fixed and variable annuities though they are defined as a fixed annuity by legal statute. PV due Present value of annuity due.

An annuity is a sum of money paid periodically at regular intervals. Assume that in the example above the annuity payment is to be received at the beginning of each year. The future cash flows of.

Thus this present value of an annuity calculator calculates todays value of a future cash flow. This third type combines types 1 and 2 above. FV of ordinary annuity which requires g 0 zero growth rate because of the same amount of PMT each period is a special case of FV of growing annuity.

On the other hand passive income can happen in the background such as an asset appreciating in value. If taken prior to age 59½ a 10 IRS penalty may also apply. Then the present value of the annuity will be.

Ordinary income is actively earned while unearned income is passive. Below you will find a common present value of annuity calculation. The annuity provider should be informed of the death of the person receiving the annuity income by a relative of the deceased the executors of the estate or their bank however it is possible for the annuity to continue to be paid after the death of that person.

Future Value Of An Ordinary Annuity Definition And How To Calculate It Accounting Hub

How To Calculate The Future Value Of An Ordinary Annuity Youtube

Future Value Of Ordinary Annuity Principlesofaccounting Com

Annuity Formula What Is Annuity Formula Examples

/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

Calculating Present And Future Value Of Annuities

How To Measure Your Annuity Due

Annuity Formula Present Future Value Ordinary Due Annuities Efm

How To Calculate The Present Value Of An Annuity Youtube

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

Calculating Present And Future Value Of Annuities

Future Value Of An Ordinary Annuity Calculator Hot Sale 55 Off Powerofdance Com

Future Value Of An Ordinary Annuity Calculator Top Sellers 60 Off Www Vicentevilasl Com

Present Value Of An Annuity How To Calculate Examples

Future Value Of An Ordinary Annuity With Derived Formula Youtube

Future Value Of Annuity Formula With Calculator

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)

Calculating Present And Future Value Of Annuities

Future Value Of An Annuity Formula Example And Excel Template

Future Value Of An Ordinary Annuity Calculator Hot Sale 55 Off Powerofdance Com